About Us

Kikoff

At Kikoff, we are dedicated to transforming the way people build and manage their credit. Our innovative financial tools and resources are designed to empower individuals on their journey to financial stability and success. With a focus on simplicity, accessibility, and user education, Kikoff provides solutions that help you take control of your credit and achieve your financial goals. Join us in making smart financial decisions and unlocking your potential for a brighter financial future.

Kikoff: The Game Changer in Building Credit and Financial Literacy

In the world of financial services, where credit scores play a pivotal role in determining financial stability, Kikoff emerges as a revolutionary platform designed to help individuals improve their credit and enhance their financial literacy. This blog post explores how Kikoff provides users with the tools they need to build their credit efficiently, and why it is becoming a go-to resource for those looking to improve their financial standing.

What is Kikoff?

Kikoff is a fintech company that specializes in helping users build their credit scores quickly and efficiently. By offering a unique credit building product and financial literacy resources, Kikoff aims to empower individuals to take control of their financial future.

The Importance of a Good Credit Score

A good credit score is essential for many aspects of financial life, from securing loans with favorable interest rates to renting an apartment and even some employment opportunities. Kikoff’s services are tailored to help individuals enhance their scores through responsible financial behavior.

How Does Kikoff Work?

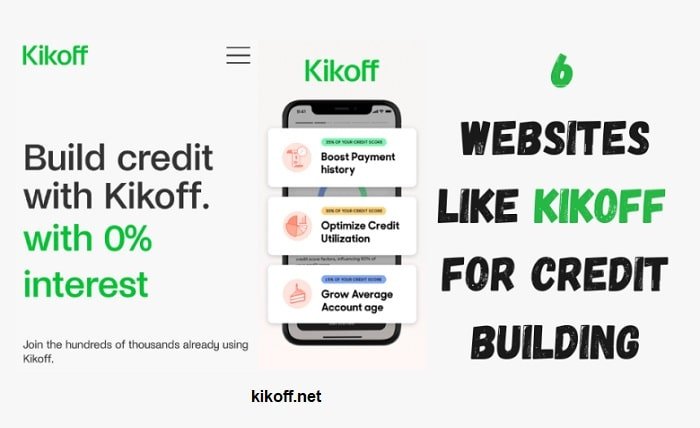

Kikoff operates by providing users with a small credit line that is used to purchase financial educational products. These transactions are reported to major credit bureaus, helping users build a history of on-time payments, which is a significant factor in credit scoring.

Kikoff’s Credit Builder Loan

One of the main features of Kikoff is its credit builder loan, which is designed to increase a user’s credit score without the risk of going into significant debt. The loan amounts are typically small and manageable, ensuring that users can consistently make payments on time.

Features and Benefits of Kikoff

Kikoff offers several features that make it appealing to users, including no interest rates, no fees, and a straightforward application process. Additionally, there is no hard credit check required, which means applying won’t negatively impact your credit score.

Financial Education with Kikoff

Beyond just helping users build credit, Kikoff provides a wealth of educational resources designed to teach better financial management skills. These resources cover topics like budgeting, saving, and understanding credit reports.

User Experience on Kikoff

Kikoff’s platform is user-friendly, designed with a straightforward, intuitive interface that makes navigating financial services easy for everyone. Whether you are a tech-savvy individual or new to digital finance tools, Kikoff ensures a smooth user experience.

Success Stories from Kikoff Users

Many users have reported positive experiences with Kikoff, noting significant improvements in their credit scores within just a few months of using the service. These success stories highlight the platform’s effectiveness and reliability in credit building.

Kikoff Mobile App

To enhance accessibility, Kikoff offers a mobile app that allows users to manage their account from anywhere. This app includes all the functionalities of the web platform, ensuring users can keep track of their progress on-the-go.

Security and Privacy on Kikoff

Security is paramount at Kikoff, which employs robust measures to protect user data and ensure privacy. Users can trust that their personal and financial information is secure when using Kikoff’s services.

Kikoff’s Impact on Financial Behavior

Kikoff not only helps in building credit but also positively influences users’ overall financial behaviors. By promoting regular, responsible financial activities, Kikoff encourages users to adopt healthier financial habits that can benefit them throughout their lives.

Conclusion

Kikoff is proving to be a valuable tool for anyone looking to improve their credit score and gain financial literacy. With its innovative approach to credit building, commitment to user education, and easy-to-use platform, Kikoff is well-suited to meet the needs of modern consumers who are striving to achieve financial stability and independence.

FAQs

How quickly can Kikoff improve my credit score? Kikoff can start improving your credit score within a few months as timely payments are reported to the credit bureaus, which is critical in building a positive credit history.

Is there any risk in using Kikoff to build credit? Kikoff is designed to minimize financial risk by offering small credit lines and ensuring that the repayment terms are manageable, making it a low-risk option for building credit.

Can anyone sign up for Kikoff? Yes, anyone looking to build or improve their credit score can sign up for Kikoff. The service is especially beneficial for those with low or no credit history.

How does Kikoff compare to other credit building tools? Kikoff is unique in that it combines credit building with financial education, providing a holistic approach to improving financial health that many other tools do not offer.

What do I need to get started with Kikoff? To get started with Kikoff, you just need to provide some basic personal information and verify your identity. There is no credit check required, so signing up is quick and easy.